Are you as confused as I am (maybe), about what’s going on in the crypto world right now with the whole FTX saga? Well, let’s see if I can explain it in a few paragraphs, especially for crypto newbies already questioning your recent life choices.

A crypto exchange collapsed, so what?! It’s not new. Why exactly is this one peculiar and causing huge uproars? We’ll see.

Okay, FTX, what’s up!

TL: DR

- FTX loaned $10 billion of customers’ crypto holdings to its sister company; a hedge fund – Alameda, owned by the same man and run by his ex. They own the crypto token, FTT.

- Alameda (Don’t try clicking the link, it doesn’t work anymore) reportedly lost it all in speculation and other funny dealings.

- A cool guy named CZ made a tweet about liquidating his company’s FTT holdings after he discovered some shady things going on with the owners. Everyone started withdrawing their holdings from FTX at the same time.

- FTX didn’t have all the money at this time and couldn’t service it. They filed for bankruptcy.

- The entire crypto market took a hit for it

But… if you are here for the long stuff, let’s take a ride.

There was a guy, well this guy here…

His name is Sam Bankman-Fried (SBF) and he founded a crypto exchange — FTX.com, second only to industry giant — Binance. They also have a token — FTX Token (FTT).

It was reported that SBF made some anti-crypto moves despite being an industry big wig. He supported a controversial crypto bill that would have threatened DeFi which is the entire reason for crypto in the first place. And, he loves giving out lots of money. He donated to election campaigns and charities.

He is currently under investigation by US regulators by the way, alongside his companies.

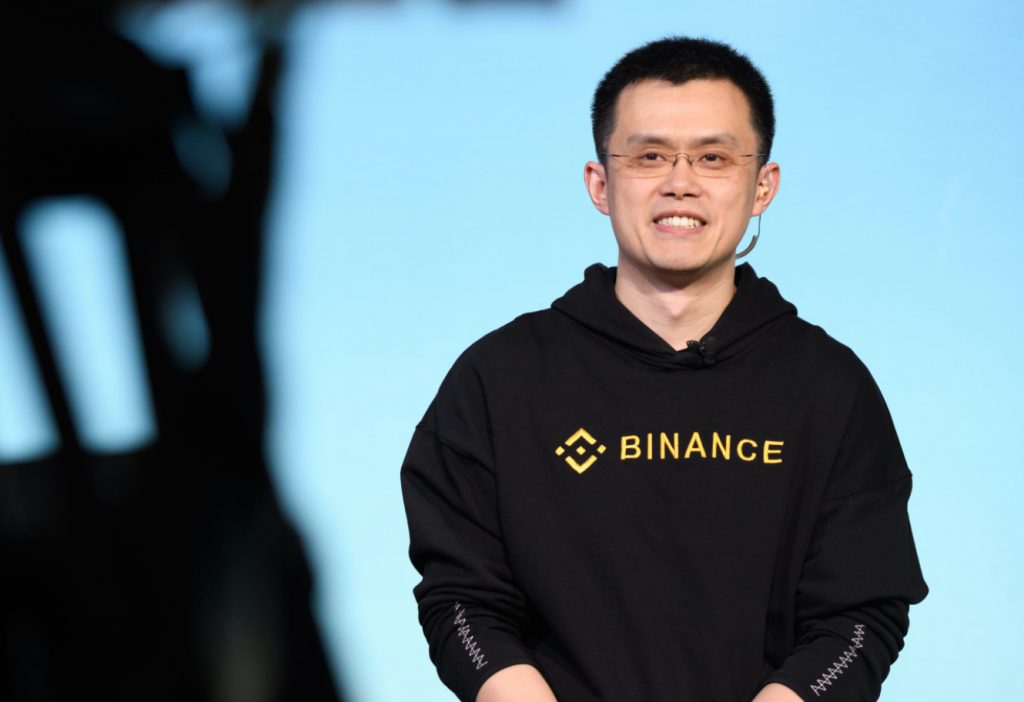

There’s this other guy.

He is Changpeng Zhao, popularly called CZ. A crypto superhero to many, others have strong reservations though. He runs the world’s biggest crypto exchange — Binance.

He is also a big proponent of DeFi and openly calls for collaboration between industry players.

So, how do they connect?

Binance invested in FTX back in 2019, and FTX rose to become number two in the world behind Binance. Last year (2021) Binance exited FTX.

As dividends from their exit, Binance received roughly $2.1 billion USD equivalent in cash (BUSD and FTT). Fast forward to November 06, 2022, CZ announced in a tweet that Binance had decided to liquidate their remaining FTT holdings “due to recent revelations that have come to light”.

Remember, CZ is a superhero, maybe not loved by all, but definitely respected. This singular tweet, along with other revelations caused panic in the market. Two things happened simultaneously.

- People started selling off FTT tokens in their bags.

- FTX users started withdrawing their funds from the exchange en masse.

Number 1 happens in crypto all the time, so not so much of a big deal, compared to number 2.

But, number 2 shouldn’t be a problem either, right?… Right???

Okay, here’s why it shouldn’t have changed anything ‘that much’ ;). Let’s do a quick crash course on how exchanges work.

We all deposit our tokens on the exchange, and trade between ourselves, and the exchange platform takes a fee from both of us for providing the market without actually owning any of the tokens. This is the most basic way they make money.

This also means we can have our tokens back whenever we want, right? Uhh right???

Back to the story.

People quickly discovered that FTX didn’t have all users’ funds at a 1:1 ratio. This means they must have used user-deposited funds for something else or maybe sent them somewhere else for safekeeping.

Of course, no exchange keeps 100% user deposited funds in hot wallets. In this case, however, even the funds in the cold storage didn’t add up.

So where did all the money go?

Just for highlights

FTX quickly shut down withdrawals since they couldn’t actually fulfill all of them. You can’t give what you don’t have, obviously. The entire incident is called a bank run.

Bank runs are not good for anyone, and the damage is heavy, however, if they held all users’ funds 1:1, then there wouldn’t have been so many problems.

Later revelations showed that most of the user funds were sent to SBF’s other company, Alameda to be used for trading and other good intentions. There was something troubling with that news though — A good amount of the holdings there were in FTT, FTX’s token.

To handle the ~$6bn withdrawals from FTX, they sold off most of their other altcoins from multiple exchanges which were not enough to settle the bank run. FTT took a massive hit which dropped their assets to nothing.

CZ through Binance offered to buy FTX in order to save the company. This plan fell through and the crypto market will never remain the same.

Several users’ funds are trapped (or gone forever) in FTX including a budding less-than-a-year-old African web3 startup — Nestcoin.

This entire debacle caused a general panic in the crypto space as the market went into a free fall.

Remember…

Not your keys, not your coins

— Crypto warlords

This guy summarised the entire gist in the funniest way we could find on the internet.